AngelNV connects early stage investors (angels) with entrepreneurs in the Nevada startup community. We provide an opportunity to learn how to invest together as part of a tight-knit community that is making lasting social and economic change. AngelNV investors meet like-minded people, start a portfolio, and gain access to an experienced investor network and high potential startups. Our first-time investors grow to be part of the state-wide Nevada ecosystem, form their own investing funds / groups and/or join other organizations like FundNV, 1864, Sierra Angels, and others – more than doubling the value of their invested capital in just 4 years, and with continued wise choices, en-route to a 5x to 10x venture portfolio return over 10 years.

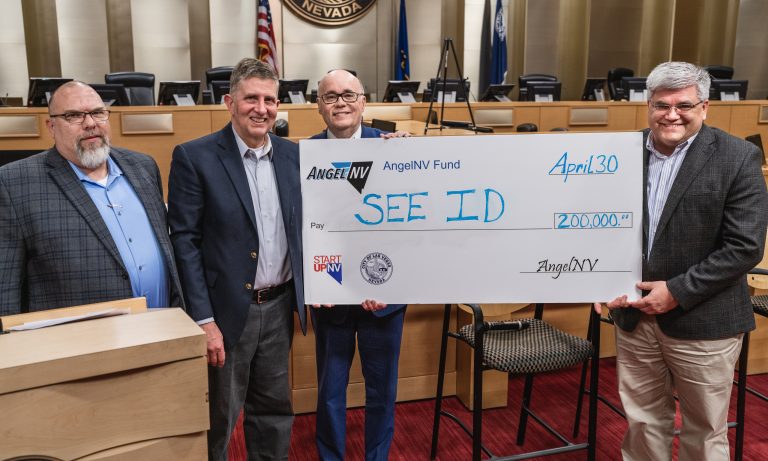

The AngelNV Conference starts with a Entrepreneur’s Track to prepare founders / companies and provide sufficient deal flow for angel investors. Founders / companies submit profiles for investor review beginning in January 2026. Investors will review applications and continue to narrow the field until the AngelNV Conference Fund awards an investment later in the spring. After multiple rounds of pitches and complete due diligence, a final winner (or winners) will be selected by participating angels to receive an investment – which is matched by the State of Nevada’s SSBCI program. In 2025, the program generated $2.88 million of total capital invested – from a baseline of 78 AngelNV investors. The founders raised additional capital which was matched.

Meet a Nevada Angel

Jeff is a serial investor and one of three fund managers at AngelNV – along with being a general partner at FundNV, 1864 and the Sierra Angels. Jeff has been leader in building a vibrant and inclusive startup community and investor ecosystem in Las Vegas and throughout Nevada. The once nascent StartUpNV angel syndicate now has more than 280 investors, about half of whom learned through the AngelNV program. Since 2021, AngelNV investors like Jeff have gone on to (collectively) fund 33 transactions in 27 companies, investing more than $12.86M – which is (as of 8/31/2025) worth 3.48 times that amount.

Schedule a chat with Jeff to see if AngelNV or startup investing is right for you. The general guidance is to invest no more than 10% of your net worth in the early stage venture investment asset class – ask Jeff or another fund manager why and how it works.

What the investment covers:

- $5,000 of unit cost is invested.

- The remaining $500 tax deductible donation is billed separately by StartUpNV (a 501c3 non-profit) and covers program operation costs, Nevada Blue Sky state fees, and fund set-up and administrative costs for the first 5 years of the life of the fund (~7 years).

- Additional units cost $5,000 (limit 4). No admin fees or donation on additional units.

- All units have voting rights – 1 vote per active unit with a max of four (4) votes, even with five (5) or more units.

- An extra one-half voting unit is awarded to diligence team leaders and fund administrators for the additional work required.

- Investors domiciled outside of Nevada may incur additional blue sky fees for their states ($300 to $500 for most states).

- Fees also include access to AngelNV Investing Bootcamp, ACA Membership, and two (2) finale event tickets.

If you’re ready to invest, click the button below to access our investor registration portal where you’ll 1.) create an account, 2.) review the investment documents, 3.) commit to an amount ($5k min). It takes less than 5 minutes. An associate will reach out to you to confirm.

You are NOT COMMITTED to invest until you sign (virtually) the fund documents. When creating an account, you will be asked to affirm that you are an accredited investor or a Nevada Certified Investor.

0Program Sessions & Schedule

This tentative schedule assumes most meetings will occur on Tuesday evenings. A poll will be taken of the investors to confirm or change the weekly meeting days and times. Attend in person in Las Vegas, or virtually via zoom. All weekly sessions are recorded and made available to all registered investors by an unlisted / private link on our YouTube Channel. Each session kicks off with a short review of the prior session.

Education – Intro to Angel Investing – Saturday, January 10, 2026 10:00 am to 3:00 pm

Intros, Team Assignments, Process Review, Dealum Intro – Tuesday, January 13, 6:00 pm

Company Reviews – Tuesday, January 20, 2026 6:00 pm

Discuss Companies and winnow – Tuesday January 27, 2026, 6:00 pm

3-Minute Pitches, Straw Poll, Vote Due by Friday – Tuesday, February 3, 2026, 6:00 pm

Discussion to winnow to 12 Companies – Tuesday, February 10, 2026 6:00 pm

10-Minute Pitches, Straw Poll, Vote Due by Friday – Tuesday, February 17, 2025 and Thursday, Feb 19 6:00

Discussion and Finalist Selection, DD Team Assignments – Tuesday, February 24, 2026 6:00 pm

DD Team Findings & Reports – Tuesday, March 3, 2026 6:00 pm

DD Team Findings & Reports – Tuesday, March 10, 2026 6:00 pm

DD Team Findings & Reports – Tuesday, March 17, 2026 6:00 pm

DD Team Findings & Reports – Tuesday, March 24, 2026 6:00 pm

DD Team Findings & Reports – Tuesday, March 31, 2026 6:00 pm

DD Reports Due by Noon – Monday, April 5, 2026

DD Discussion and Straw Poll – Tuesday, April 6, 2026

Finale Event – Saturday, April 11, 2026 1 to 4 pm

What is StartUpNV(SNV)?

Why is StartUpNV running AngelNV?

To educate accredited and Nevada certified investors on how to be successful angel investors in Nevada startups, growing our local startup ecosystem, diversifying our Nevada economy, and giving our local investors the chance to succeed in Nevada.

Why should I invest in AngelNV?

First and foremost, we believe the AngelNV training, low cost, and risk mitigation will produce a competitive return over time. Additionally, AngelNV provides an opportunity to help develop a sustainable startup ecosystem throughout the state of Nevada that historically has been neglected by the venture industry. It is also an opportunity to attract scalable startup business and founders with big ideas to the state and build a more resilient state economy.

How much can I invest?

Active and passive member units are priced at $5000 each, with an additional administrative and legal service fee of $500 per unit. The minimum investment is 1 unit, there is no maximum up to 40 unit total amount of the fund. Only the first four units will have voting power.

What kind of returns can I expect?

How much risk is involved?

Who can invest in the fund?

Accredited Investors as defined by the US Securities and Exchange Commission, and Nevada Certified Investors.

What are the investor terms of AngelNV?

AngelNV is targeting a fund totaling $200,000 (or more) for each cohort of AngelNV. Member units are priced at $5000 each, with an additional adminstrative fee of $500 per initial unit. The fund will be managed through the Dealum platform and offers access to the investors for tax and legal documents.

Who will manage AngelNV?

An Investment Committee (IC) of “Active” members selected by StartUpNV and AngelNV LP’s (members). An “Active” member Angel is committed to attending all of the training and at least 60% of the periodic meetings about the companies. Other members may invest passively and participate occasionally in training and meetings, but will not participate in the final selection.

What type of startups will the fund invest in?

How will AngelNV source deal flow?

What is the maximum initial investment by AngelNV that will be allowed per company?

The maximum total investment from AngelNV will be $400,000 per company from the conference fund. Additional funds will be invested in secondary/tertiary companies as decided by the Angels in advance of the final vote for investments.

How big will the fund be?

Where can I find information about this type of investment?

Once I invest, may I withdraw my funds before the fund is terminated?

Can I invest with IRA assets?

What type of legal entity is the fund?

What kind of reporting will I get?

The fund is using the Dealum platform for all back-office reporting requirements. You will be able to access information via Dealum including annual tax filings for the fund investments. Quarterly investment newsletters on fund performance are emailed to the email on record on the Dealum platform.

Can I invest additional money as a Limited Partner (member) with AngelNV?

As a Limited Partner, am I allowed to negotiate terms of the Limited Partnership agreement for the Fund?

No, the terms of the LP (LLC Member) agreement are set by the private placement memorandum and cannot be modified.