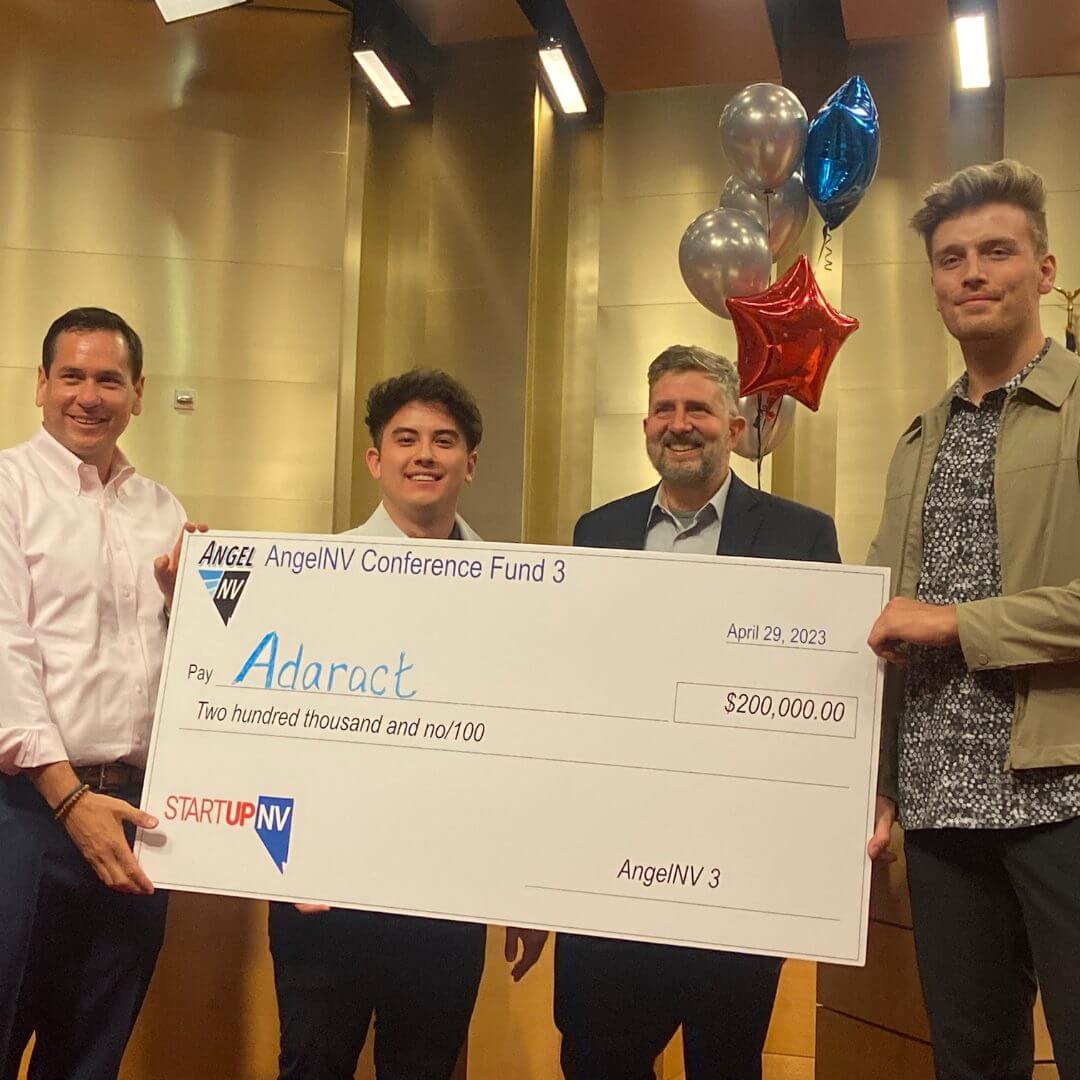

2023 AngelNV Winner: Adaract

Founders pictured: Clay Payson and Marcus D’Ambrosio

Accompanied by: Francisco Aguilar, NV Secretary of State (left) and Jeff Saling, Executive Director of StartUpNV (third from left)

Nevada Angel Investors want to invest $400,000* in your company

The accelerator and funding process is easy to follow:

1) Register for Bootcamp

Attend the FREE entrepreneur boot camp that could change the future of your company! The bootcamp will likely occur in October 2024.

The OPTIONAL application for angel funding is due at the end of boot camp in January 2025. Applicants for funding can continue to update company information through ten days after the application due date.

2) Apply for Angel Funding

The funding application deadline is January 2025.

It is completely free to apply for AngelNV 5. The investors securely review information to determine finalists on the same platform as the applicaion, Dealum.

3) Participate in Selection

Investors review applications and select deals to move to each round.

Entrepreneurs are encouraged to provide detailed information and continue updating their profile until the angels have access to the applications.

4. Attend the Conference

Every applicant is encouraged to attend the “finals” to network with investors, connect with other entrepreneurs, and learn from presenters.

We are offering 1 ticket with the application fee for founders. All tickets include 2 drinks + appetizers.

What is StartUpNV?

StartUpNV (SNV) is a NV statewide accelerator and incubator that helps Founders/Startups to Create, Collaborate on and Capitalize their businesses by providing mentoring and support services, as well as fostering fund formation to invest in Nevada companies.

Why did StartUpNV create AngelNV?

To educate accredited investors on how to be successful angel investors in Nevada startups, growing our local startup ecosystem, diversifying our Nevada economy, and giving our local investors the chance to succeed in Nevada.

What are the investor terms of AngelNV?

AngelNV is targeting a fund totaling $400,000 (or more) on or before April 29, 2023. Member units are priced at $5,000 each, with an additional administrative and legal fee of $1,000 per unit for active investors. Investors may also choose passive investing, where they have no votes and the administrative legal fee is $500. The conference fund requires Limited Partners (members) to be Accredited Investors.

Who will manage AngelNV?

Because this is a conference fund, the active investors will vote collectively on which startups to pursue through a series of pitches. The process uses the votes to arrive at about 6 finalist companies that the active angels will perform due diligence on. An “Active” member Angel is committed to attending all of the training and at least 60% of the periodic meetings about the companies. Other accredited members may invest passively and participate occasionally in training and meetings, but will not participate in the final selection. Management of the tax filings is handled by the service provider.

Who can invest in the fund?

How will AngelNV source deal flow?

AngelNV expects that the extensive statewide network of StartUpNV will provide sufficient applicants to the conference fund. To enable this, AngelNV includes an Entrepreneur Bootcamp that runs in the fall, preparing founders for the AngelNV Investor Bootcamp.

How large will the fund be?

AngelNV will be $200,000 to $400,000 with a targeted minimum investment of $200,000, which will be matched by SSBCI funds 1:1. The final amount raised by investors will be matched, and the companies receiving the investments will be decided on April 27, 2024 at the finale event at Las Vegas City Hall.

What is the maximum initial investment by AngelNV that will be allowed per company?

The first place winner of AngelNV will receive a minimum $200,000, matched by SSBCI funds for a total of $400,000. The angel group will vote on secondary and tertiary investments just before the finale, depending on the results of due diligence and amount of funds available. These investments will also be matched by SSBCI funds. All the investments are through a Special Purpose Vehicle type fund. (SPV).

How much can I invest?

Active and passive member units are priced at $5,000 each, with an additional administrative and legal service fee of $500 for the first unit. Passive investors may join for $5,000 per unit. Passive investors do not have to attend the sessions or perform due diligence. The minimum investment is 1 unit, there is no maximum up to 40 units, although no investor will have more than 4 votes (1 per unit up to 4).

How much risk is involved?

This segment of Asset Class, early stage startup companies, is considered to be very risky and it is possible for you to lose your entire investment given the very high risk. Prospective investors should give careful consideration to actual and potential risk factors and conflicts of interest discussed in the PPM in evaluating the merits and suitability of an investment in the fund. An investment in the fund, and the portfolio companys’ securities, involves considerable potential risks including the possible loss all or a material portion of your investment. You should closely review the written AngelNV “Risk Factors” noted in the PPM when considering an investment in AngelNV.

Why should I invest in AngelNV?

First and foremost, we believe the AngelNV training, low cost, and risk mitigation will produce a competitive return over time. Additionally, AngelNV provides an opportunity to help develop a sustainable startup ecosystem throughout the state of Nevada that historically has been neglected by the venture industry. It is also an opportunity to attract to the state scalable startup businesses and founders with big ideas and build a more resilient state economy.

Where can I find information about this type of investment?

Typical sites that contain information about risks, returns, etc., are the Kauffman Foundation, Angel Capital Association, and the National Venture Capital Association. You can find out detailed information about AngelNV in the fund’s Private Placement Memorandum (PPM). Please request access via email to jeff@startupnv.org

What type of startups will the fund invest in?

AngelNV LP’s (limited partner members) make the final decisions about what company or companies receive investment. The AngelNV conference will seek applications from a wide array of scalable startup companies, primarily based in Nevada.

Once I invest, may I withdraw my funds before the fund is terminated?

No. You should only consider investing if you are comfortable with potentially losing all of your investment — or not seeing any return for at least 7 years — and possibly closer to 10 years. The clear objective of any AngelNV conference fund is to earn a substantial return, however, investments in early-stage companies are risky. While we seek to mitigate that risk by providing education through the AngelNV conference, the investment risks remain very high.

Can I invest with IRA assets?

Yes, so long as your IRA documentation and Institution allow such an investment.

What type of legal entity is the fund?

It is a Nevada LLC.

What kind of reporting will I get?

The fund is using a service provider platform for all back-office reporting requirements. You will be able to access information via the provider, including annual updates on fund investments. StartUpNV will send quarterly investor updates via email.

Can I invest additional money as a Limited Partner (member) with the AngelNV?

Yes, to the extent the company seeking funding via the AngelNV requires additional capital and that company allows additional investment for the AngelNV via a “sidecar” mechanism. The finalist companies may create sidecars for investment whether they win the overall AngelNV fund investment or not. There is no requirement that AngelNV members invest in any sidecars.

As a Limited Partner, am I allowed to negotiate terms of the Limited Partnership agreement for the Fund?

No, the terms of the LP (LLC Member) agreement are set by the provider, cannot be modified, and are part of the investment agreement.

What kind of returns can I expect?

What is the relationship between AngelNV and StartUpNV?

StartUpNV is the organizer of AngelNV, but they are separate legal entities. StartUpNV is an IRS approved 501(c)3 non-profit. AngelNV is a for profit venture fund formed as a Nevada LLC.

There’s no need to wait. Confirm your participation now before before the sessions begin in October, 2024 at 5:30 pm local time. Any entrepreneur, any company with a product and/or, any startup can register for the AngelNV bootcamp. The application process is straight forward. During the bootcamp, entrepreneurs can apply for angel funding – which starts immediately after bootcamp completion.